Eurostatistics - data for short-term economic analysis

Data extracted on 19 April 2024.

Planned article update: 24 May 2024.

Latest macroeconomic developments

Highlights

In March 2024, euro area inflation decelerated while economic sentiment and employment expectations both increased.

In the 4th quarter of 2023, there was no change in GDP in the euro area (when compared with the previous quarter).

In February 2024, industrial production in the euro area increased (compared with the previous month) while retail trade sales decreased.

Click on the picture to access the interactive data visualisation

This monthly article gives a picture of the macroeconomic situation in the euro area, the European Union (EU), and the EU countries, showing relevant indicators of production, demand, labour and prices, as well as interest and exchange rates. These are based on the principal European economic indicators (PEEIs). Note that rates of change for all monetary indicators (such as gross domestic product (GDP), industrial production and retail sales) are presented in real terms, in other words, after removing the impact of price changes.

The article is complemented by a data visualisation offering additional indicators and interactive graphs; it also includes links to source data. Looking for the freshest information? Real-time updates of data can be found in the form of graphs and tables in the Euro indicators dashboard with advanced functionalities to explore and download them.

Based on the figures available on 19 April 2024, the economic situation in the euro area and the EU is characterised by

- a continued deceleration of inflation (as measured by the all-items harmonised index of consumer prices (HICP)) in March 2024

- no change in GDP in the 4th quarter of 2023 in the EU and a decline of 0.1% in the euro area

- an increase in industrial production and production in construction in February 2024

- a decrease in retail trade sales in February 2024

- a stable unemployment rate in February 2024

- an increase in economic sentiment in March 2024

- a slight increase in the level of employment expectations in March 2024.

The economic situation in both the euro area and the EU continued to show resilience yet was characterised by high uncertainty due to the deterioration of the geopolitical situation. Positive signals are disinflation (decelerating inflation), increasing industrial and construction production, the stable unemployment rate and increasing economic sentiment and employment expectations. By contrast, there was a decline in retail trade sales and a mixed picture concerning GDP, with stability in the EU and a slight decline in the euro area.

Full article

Situation in the euro area and the EU

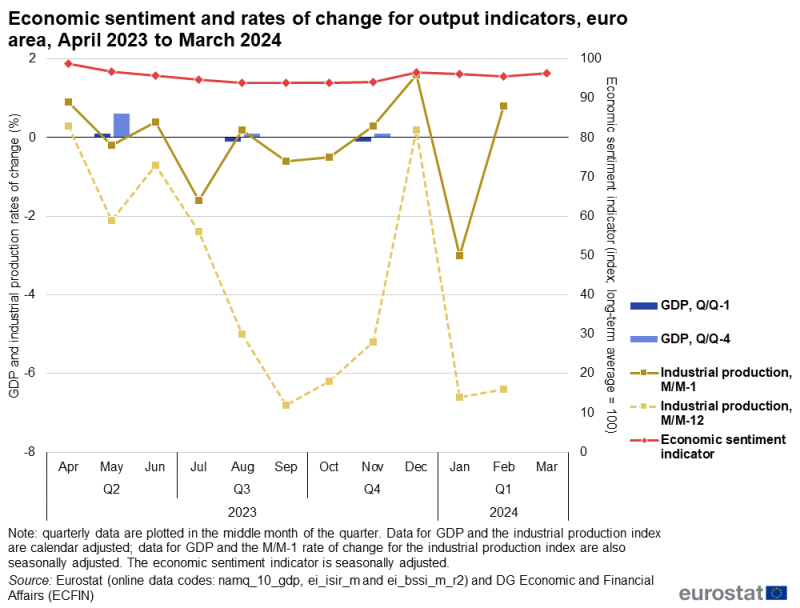

In the 4th quarter of 2023, seasonally adjusted GDP decreased by 0.1% quarter-on-quarter in the euro area and was unchanged in the EU. For comparison, in the 3rd quarter of 2023, GDP had also decreased by 0.1% in the euro area and had also been unchanged in the EU. Compared with the 4th quarter of the previous year, GDP was 0.1% higher in the 4th quarter of 2023 in the euro area and 0.2% higher in the EU.

In February 2024, seasonally adjusted industrial production increased month-on-month by 0.8% in the euro area and by 0.7% in the EU. In the previous month, it had decreased by 3.0% in the euro area and by 2.7% in the EU. Compared with February 2023, industrial output was 6.4% lower in February 2024 in the euro area and 5.4% lower in the EU.

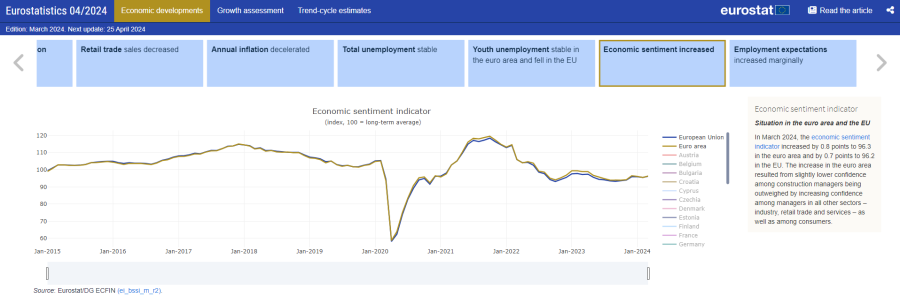

In March 2024, the economic sentiment indicator increased by 0.8 points to 96.3 in the euro area and by 0.7 points to 96.2 in the EU. The increase in the euro area resulted from slightly lower confidence among construction managers being outweighed by increasing confidence among managers in all other sectors – industry, retail trade and services – as well as among consumers.

Source: Eurostat (namq_10_gdp), (ei_isir_m) and (ei_bssi_m_r2) and DG Economic and Financial Affairs (ECFIN)

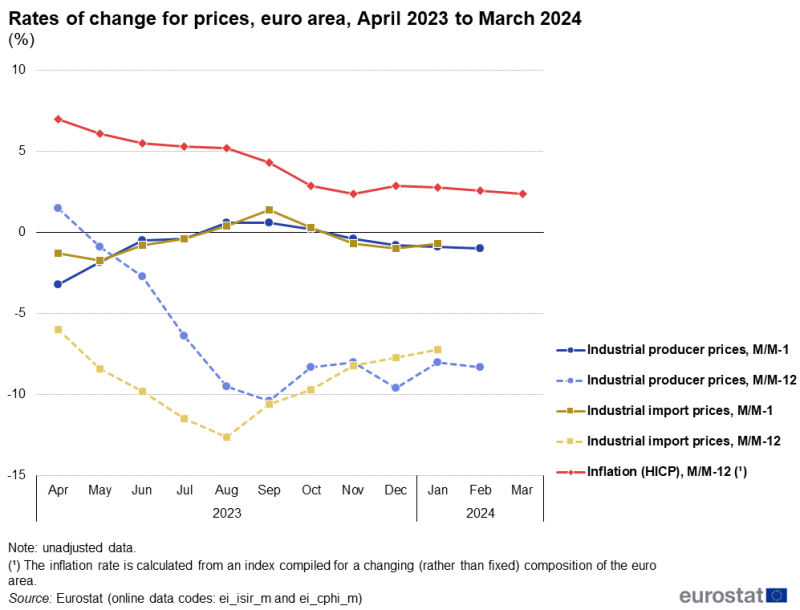

Over the past year, the rate of inflation (based on the HICP) slowed considerably. In the euro area, the inflation rate fell from 6.9% in March 2023 to 2.4% in March 2024; in the EU, it fell from 8.3% in March 2023 to 2.6% in March 2024. Year-on-year rates of change for industrial producer and import prices also decelerated and in fact turned negative.

According to the latest data from Eurostat, the annual inflation rate (based on the HICP) in the euro area was 2.4% in March 2024, down from a rate of 2.6% in the previous month. The category of services recorded the highest annual rate in March 2024 (prices were up 4.0%, which was the same rate as in the previous 4 months), followed at some distance by food, alcohol and tobacco (up 2.6% in March 2024 after an increase of 3.9% in February 2024) and non-energy industrial goods (up 1.1%, compared with 1.6% in February 2024). By contrast, the annual rate for energy remained negative in March 2024 (down 1.8%), a considerably smaller fall than in February 2024 (down 3.7%). In the EU, annual inflation was 2.6% in March 2024, down from 2.8% in the previous month.

Compared with a year earlier, industrial producer prices in February 2024 were 8.3% lower in the euro area and 8.1% lower in the EU; in January 2024, they had been, respectively, 8.0% and 7.9% lower than a year earlier. Turning to month-on-month changes, industrial producer prices decreased in February 2024 by 1.0% in the euro area and by 0.9% in the EU; these were similar to the decreases observed in the previous month (down 0.9% in both the euro area and the EU).

Compared with a year earlier, industrial import prices in January 2024 were 7.2% lower in the euro area and 6.9% lower in the EU than they had been a year earlier. On the basis of a month-on-month comparison, industrial import prices decreased in January 2024 by 0.7% in the euro area and by 0.8% in the EU.

(%)

Source: Eurostat (ei_isir_m) and (ei_cphi_m)

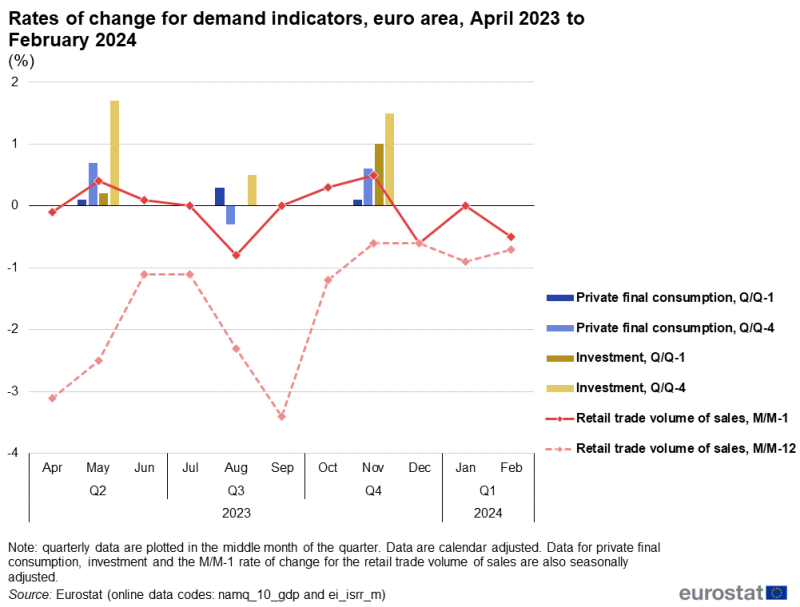

In the 4th quarter of 2023

- private final consumption expenditure increased quarter-on-quarter by 0.1% in the euro area and by 0.2% in the EU (after increases of 0.3% in both the euro area and the EU in the previous quarter)

- government final consumption expenditure increased by 0.5% in the euro area and by 0.4% in the EU (after increases of 0.7% in the euro area and 0.6% in the EU in the previous quarter)

- gross fixed capital formation (investment) increased by 1.0% in the euro area and by 0.9% in the EU (after no change in the euro area and an increase of 0.1% in the EU in the previous quarter).

In February 2024, the seasonally adjusted volume of sales in retail trade decreased month-on-month by 0.5% in the euro area, following on from no change in the previous month. In the EU, retail sales decreased by 0.4% in February 2024, having increased by 0.2% in the previous month.

(%)

Source: Eurostat (namq_10_gdp) and (ei_isrr_m)

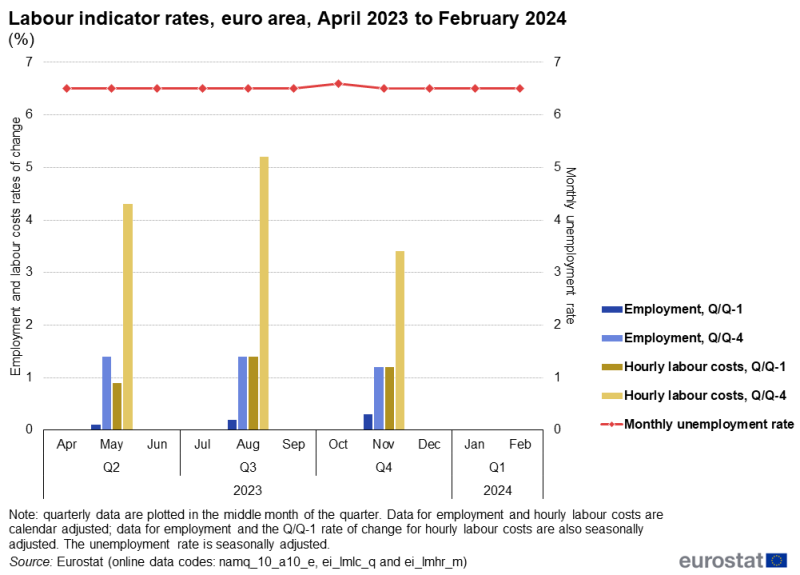

In February 2024, the seasonally adjusted unemployment rate was 6.5% in the euro area, the same as it had been in each of the previous 3 months. In the EU, the rate remained at 6.0%, the same as it had been in the previous 2 months. Compared with February 2023, unemployment in February 2024 was lower by 30 000 people in the euro area and higher by 156 000 people in the EU. In February 2024, the youth unemployment rate (for people aged 15–24 years) was 14.6% in the euro area, stable compared with the previous 3 months. In the EU, the rate was 14.8%, down from 14.9% in the previous month. The rate for people aged 25 years or older was 5.7% in the euro area and 5.2% in the EU, up from 5.6% in the previous month in the euro area and unchanged in the EU.

In the 4th quarter of 2023, the number of people in employment increased by 0.3% in the euro area and by 0.2% in the EU compared with the previous quarter, following increases of 0.2% in the 3rd quarter of 2023 in both. Compared with the 4th quarter of 2022, employment in the 4th quarter of 2023 was 1.2% higher in the euro area and 1.1% higher in the EU.

Compared with the previous quarter, hourly labour costs increased by 1.2% in both the euro area and the EU in the 4th quarter of 2023; in the 3rd quarter of 2023, there had been increases of 1.4% in the euro area and 1.5% in the EU. Compared with the 4th quarter of 2022, hourly labour costs in the 4th quarter of 2023 were 3.4% higher in the euro area and 4.0% higher in the EU.

The employment expectations indicator, as measured by business and consumer surveys, increased marginally in the euro area in March 2024, up 0.1 points. This was due to less pessimistic employment plans among industrial managers and more optimistic plans among construction and retail trade managers more than offsetting less optimistic plans among services managers. In the EU, the situation was similar: less pessimistic employment plans among industry and construction managers and more optimistic plans among retail trade managers more than balanced the more pessimistic plans in services such that the overall index increased by 0.1 points. In March 2024, the index level (with a long-term average = 100) of the indicator was 102.6 in the euro area and 102.3 in the EU.

(%)

Source: Eurostat (namq_10_a10_e), (ei_lmlc_q) and (ei_lmhr_m)

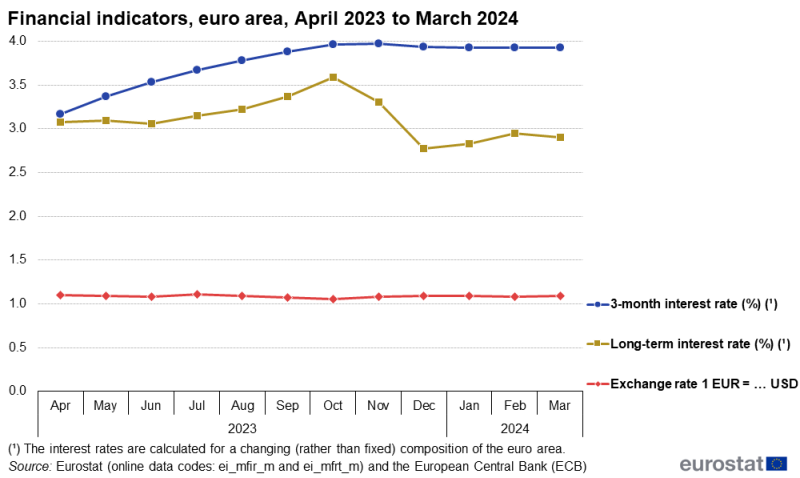

Interest rates

On 11 April 2024, the Governing Council of the European Central Bank (ECB) decided to keep the 3 key ECB interest rates unchanged. Accordingly, the interest rates on the main refinancing operations, the marginal lending facility and the deposit facility remained at 4.50%, 4.75% and 4.00%, respectively.

The euro area’s 3-month interest rate, the Euro Interbank Offered Rate (Euribor), remained stable at 3.92% in March 2024. Long-term interest rates (monthly average weighted 10-year government bond yields) of the euro area decreased to 2.90% in March 2024 from 2.95% in the previous month. The EU’s long-term interest rates on government bonds decreased to 3.23% in March 2024 from 3.26% in the previous month.

Exchange rates

In March 2024 (compared with the previous month), the monthly averages of day-to-day exchange rates were as follows

- euro-US dollar: USD 1.0872 (up from USD 1.0795)

- euro-Japanese yen: JPY 162.77 (up from JPY 161.38)

- euro-Swiss franc: CHF 0.9656 (up from CHF 0.9462).

Source: Eurostat (ei_mfir_m) and (ei_mfrt_m) and the European Central Bank (ECB)

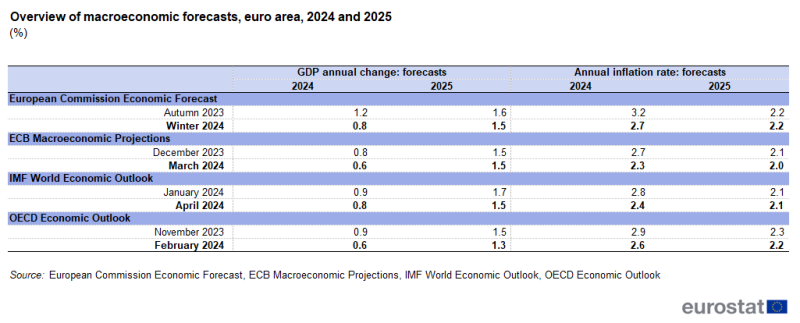

Latest macroeconomic forecasts

The latest available forecasts by 4 international organisations – the European Commission (EC) [1], the ECB [2], the Organisation for Economic Co-operation and Development (OECD) [3] and the International Monetary Fund (IMF) confirmed for the euro area moderate economic growth in 2024, with growth forecasted to approximately double in 2025. All 4 of these organisations revised their growth forecasts for 2024 downwards in their latest forecasts compared with their previous ones. Aside from the ECB (no change), growth forecasts for 2025 were also revised downwards. Annual inflation is projected to be lower in 2025 than in 2024, although all 4 of these organisations revised their inflation forecasts for 2024 downwards in their latest forecasts. Overall, the European Commission forecasts a delayed rebound in growth amid a faster easing of inflation than previously expected.

According to the latest information, euro area economic growth (based on real changes in GDP) is forecasted to be 0.6% (ECB and OECD) or 0.8% (European Commission and IMF) for 2024. For 2025, economic growth is forecasted to be 1.3% (OECD) or 1.5% (European Commission, ECB and IMF).

Compared with its previous forecast in autumn 2023, the European Commission revised down the forecasted annual inflation rate for the euro area for 2024 (to 2.7% from 3.2%) and maintained its forecast for 2025 at 2.2%. In March 2024, the ECB forecasted euro area annual inflation of 2.3% for 2024 (revised down from 2.7% in the previous forecast) while it revised down its forecast for 2025 from 2.1% to 2.0%. In April 2024, the IMF estimated an annual inflation rate for the euro area of 2.4% for 2024 (down from 2.8% in the previous forecast), followed by a lower rate of 2.1% for 2025 (unchanged from its previous forecast). In its interim report in February 2024, the OECD updated its inflation forecasts to 2.6% for 2024 (revised down from 2.9% in its previous forecast) and to 2.2% for 2025 (down from 2.3% in its previous forecast).

The euro area’s economy has lost momentum against the background of a high cost of living, weak external demand, monetary tightening and the partial withdrawal of fiscal support. A sustained and strong decrease in energy prices has contributed to a moderation of inflationary pressures. Nevertheless, risks to international trade remain due to protracted geopolitical tensions.

Read more under Latest forecasts indicate a delayed rebound in growth amid faster easing of inflation in the data visualisation.

Situation in the EU countries

In the 4th quarter of 2023, GDP development showed a mixed picture among the EU countries. Based on the latest quarter-on-quarter rates of change, GDP increased in the 4th quarter of 2023 in 16 countries, decreased in 7 and remained stable in 4. Denmark (up 2.6%), Croatia (up 1.3%) and Slovenia (up 1.1%) recorded the largest increases of GDP. The largest decrease, by far, was observed in Ireland (down 3.4%).

The highest estimated annual inflation rates (based on the HICP) [4] in March 2024 were recorded in Romania (up 6.7%), Croatia (up 4.9%), Estonia and Austria (both up 4.1%). The lowest inflation rates were recorded in Lithuania (up 0.4%), Finland (up 0.6%), Denmark (up 0.8%), Latvia (up 1.0%) and Italy (up 1.2%).

In February 2024, the lowest unemployment rates were recorded in Czechia (2.6%), Poland (2.9%), Slovenia (3.1%), Malta and Germany (both 3.2%). The highest rates were in Spain (11.5%) and Greece (11.0%). Eurostat estimates that 13.2 million people in the EU were unemployed in February 2024; 11.1 million of these people were in the euro area.

In March 2024, the economic sentiment indicator showed a generally upward picture among the EU countries, increasing in 20, stable in 1 and decreasing in 5 (Ireland, no data available). The index level of the economic sentiment indicator (with a long-term average = 100) varied substantially, from 83.3 in Estonia to 112.7 in Croatia.

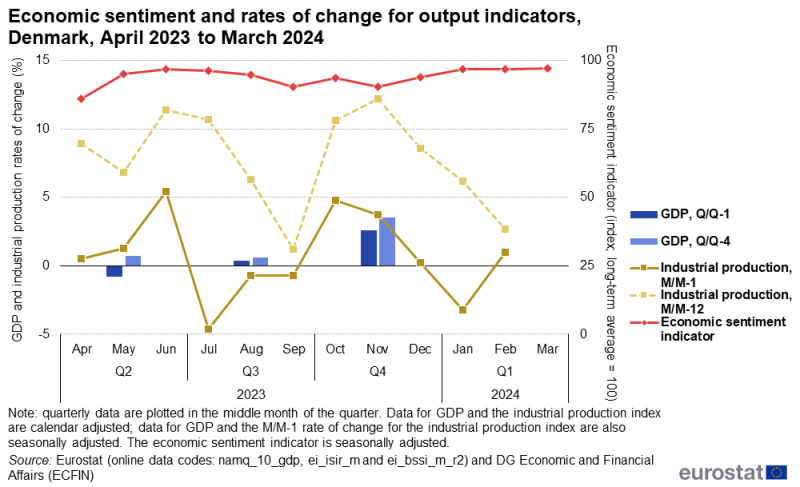

Country in focus – Denmark

The economy in Denmark expanded in the 4th quarter of 2023. Quarter-on-quarter, GDP increased by 2.6%, the largest increase among the EU countries; this followed an increase of 0.4% in the previous quarter. GDP was 3.5% higher in the 4th quarter of 2023 than a year earlier.

Industrial production increased month-on-month by 1.0% in February 2024, after a decrease of 3.2% in the previous month.

In March 2024, the economic sentiment indicator increased by 0.3 points to 97.1, after a decrease of 0.1 points in the previous month.

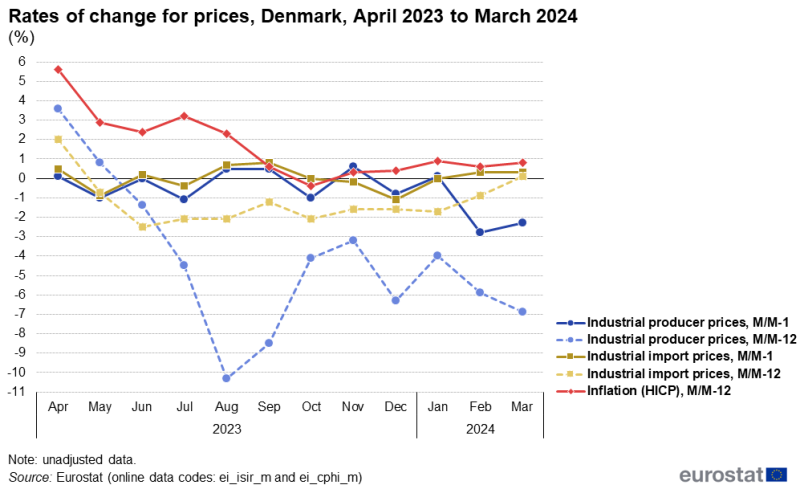

Annual inflation increased in March 2024, up to 0.8% from 0.6% in the previous month but down from 7.3% a year earlier (March 2023). Despite the latest increase, in March 2023 Denmark had the 3rd lowest inflation rate among EU countries.

Industrial producer prices were 6.9% lower in March 2024 than a year earlier and 2.3% lower than the previous month.

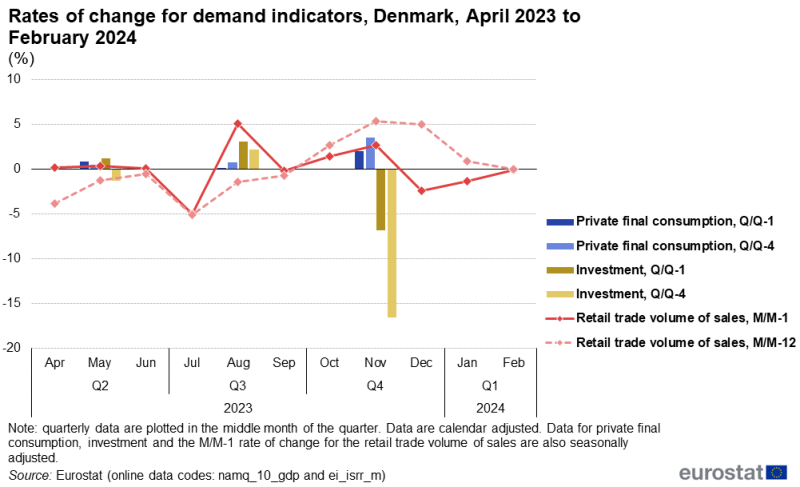

The volume of retail sales decreased month-on-month by 0.1% in February 2024, having fallen by 1.3% in the previous month.

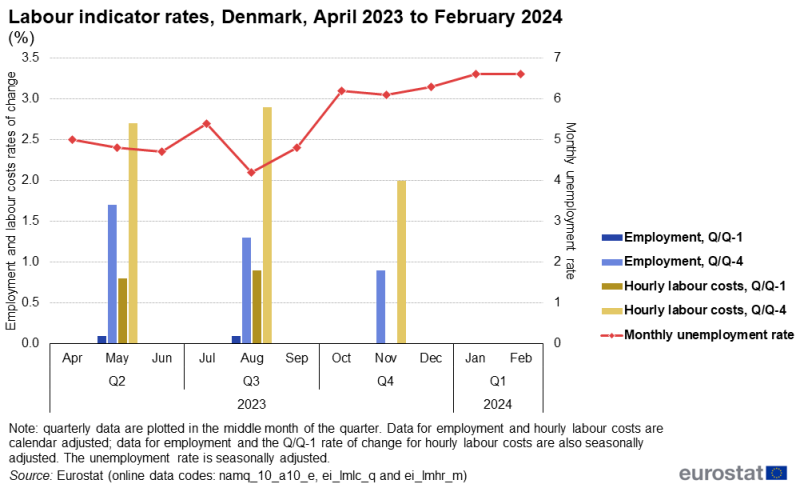

The unemployment rate in February 2024 was 6.6%, the same as in the previous month. The monthly unemployment rate had remained between 4.2% and 5.4% from January to September 2023 but ranged from 6.1% to 6.6% since then. Approximately 217 000 people were unemployed in February 2024, of which 76 000 were young people (aged under 25 years).

Source: Eurostat (namq_10_gdp), (ei_isir_m) and (ei_bssi_m_r2) and DG Economic and Financial Affairs (ECFIN)

(%)

Source: Eurostat (ei_isir_m) and (ei_cphi_m)

(%)

Source: Eurostat (namq_10_gdp) and (ei_isrr_m)

(%)

Source: Eurostat (namq_10_a10_e), (ei_lmlc_q) and (ei_lmhr_m)

Situation in the largest EU economies

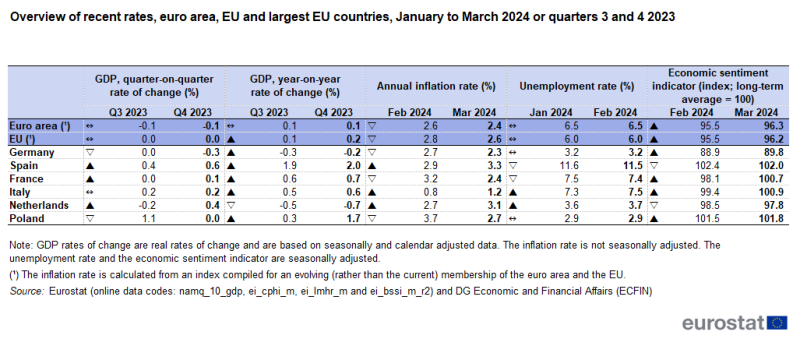

Among the 6 largest EU economies, GDP showed a generally positive or stable picture in the 4th quarter of 2023, with growth in 4 of these countries (highest at 0.6% in Spain), no change in 1 (Poland) and a contraction in 1 (Germany). In March 2024, the annual inflation rate was higher than in the previous month in 3 of these countries and lower in 3. The highest annual inflation rate among these economies was recorded in Spain (3.3%) and the lowest in Italy (1.2%). The latest unemployment rates are for February 2024: these were lower than in the previous month in 2 of the largest countries, unchanged in 2 and higher than in the previous month in the other 2. Spain recorded the highest unemployment rate (11.5%) and Poland the lowest (2.9%). Economic sentiment showed a mixed development in March 2024, decreasing in 2 of these economies and increasing in the remaining 4.

Source: Eurostat (namq_10_gdp), (ei_cphi_m), (ei_lmhr_m) and (ei_bssi_m_r2) and DG Economic and Financial Affairs (ECFIN)

Country in focus – Italy

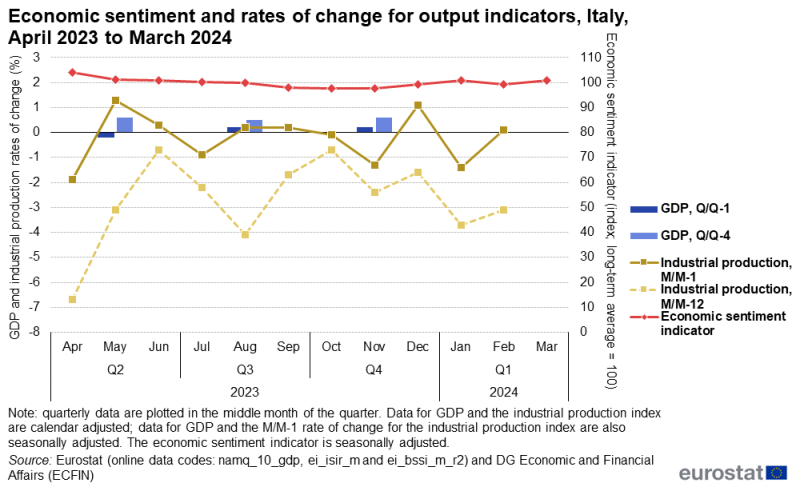

Compared with the previous quarter, GDP in Italy expanded by 0.2% in the 4th quarter of 2023; this followed on from a similar-sized increase in the previous quarter. GDP was 0.6% higher in the 4th quarter of 2023 than a year earlier.

Industrial production expanded marginally month-on-month in February 2024, up 0.1% after a decrease of 1.4% in the previous month. Overall, industrial production was 3.1% lower in February 2024 than a year earlier.

In February 2024, the economic sentiment indicator increased by 1.5 points to 100.9, after a decrease of 1.5 points in the previous month.

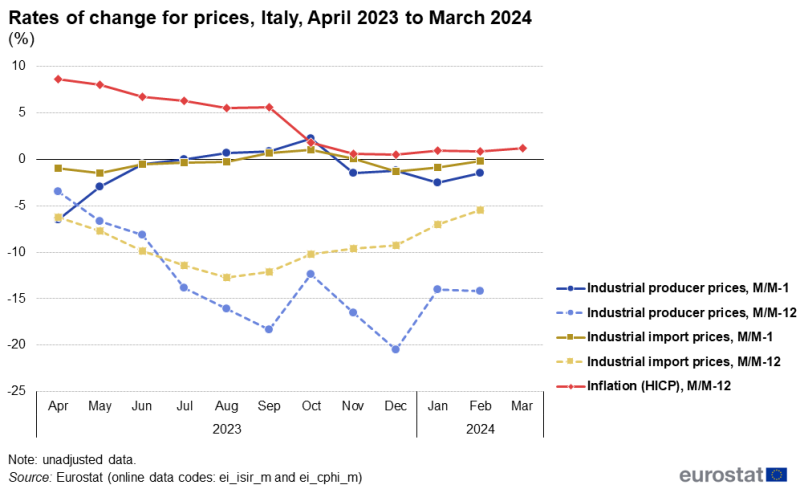

The annual inflation rate was 1.2% in March 2024, up from 0.8% in the previous month and considerably lower than the 8.1% rate recorded a year earlier in March 2023.

The month-on-month decrease of 1.5% in February 2024 contributed to industrial producer prices being 14.2% lower in February 2024 than a year earlier.

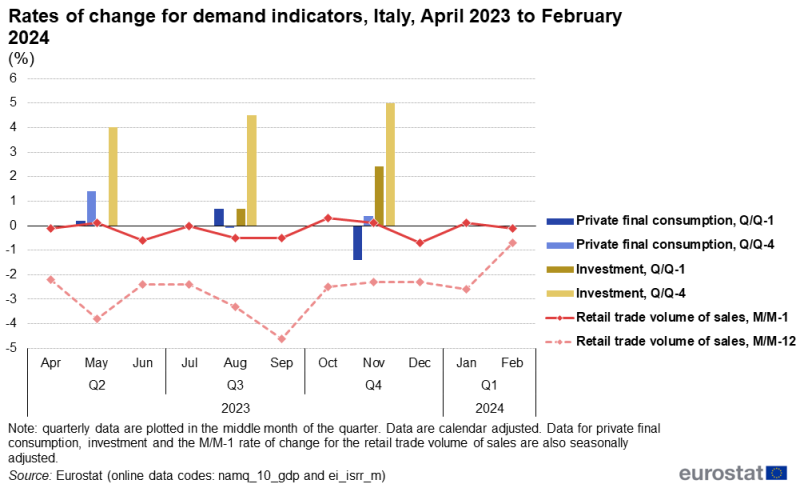

The volume of retail sales decreased slightly in February 2024, down 0.1%. This reversed an increase of the same amount in the previous month.

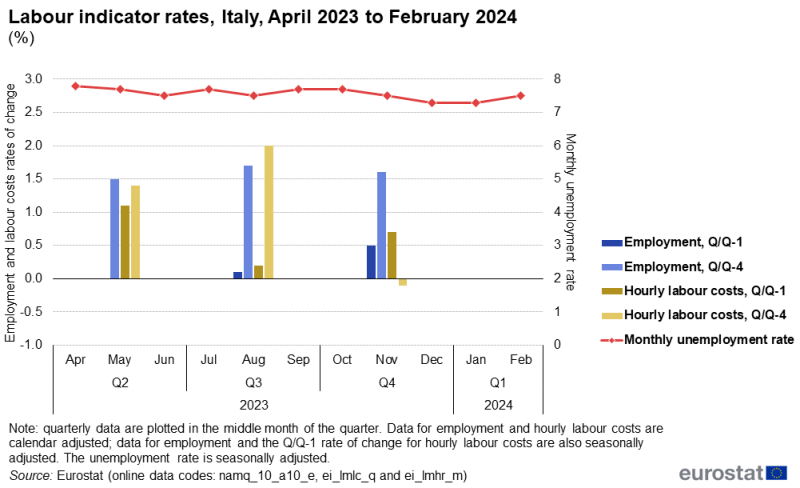

An unemployment rate of 7.5% was recorded in February 2024, up from 7.3% in each of the previous 2 months. In February 2024, approximately 1.91 million people were unemployed in Italy, of which 343 000 were young people (aged under 25 years).

Source: Eurostat (namq_10_gdp), (ei_isir_m) and (ei_bssi_m_r2) and DG Economic and Financial Affairs (ECFIN)

(%)

Source: Eurostat (ei_isir_m) and (ei_cphi_m)

(%)

Source: Eurostat (namq_10_gdp) and (ei_isrr_m)

(%)

Source: Eurostat (namq_10_a10_e), (ei_lmlc_q) and (ei_lmhr_m)

International context

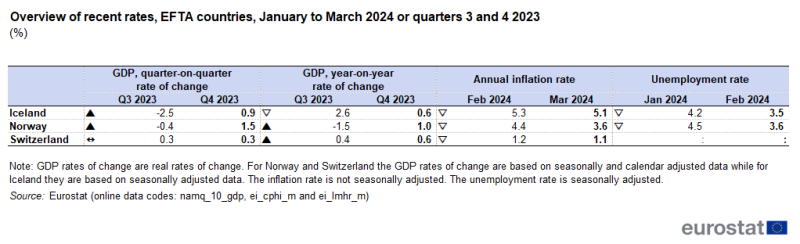

Situation in the EFTA countries

- Compared with the previous quarter, GDP expanded in the 4th quarter of 2023 in Norway (up 1.5%), Iceland (up 0.9%) and Switzerland (up 0.3%).

- In March 2024, Iceland recorded the highest annual inflation rate (up 5.1%), followed by Norway (up 3.6%) and Switzerland (up 1.1%). All of these rates were lower than those of the previous month.

- In February 2024, the unemployment rate dropped in Norway (to 3.6% from 4.5%) and Iceland (to 3.5% from 4.2%). In December 2023, the unemployment rate in Switzerland was 4.1%.

(%)

Source: Eurostat (namq_10_gdp), (ei_cphi_m) and (ei_lmhr_m)

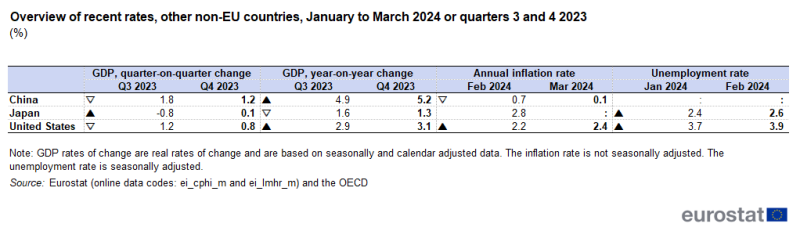

Situation in other non-EU countries

- Compared with the previous quarter, GDP expanded in the 4th quarter of 2023 in China by 1.2%, in the United States by 0.8% and in Japan by 0.1%. Compared with the 4th quarter of 2022, GDP was 5.2% higher in China, 3.1% higher in the United States and 1.3% higher in Japan.

- In March 2024, the annual inflation rate decreased to 0.1% (from 0.7%) in China and increased from 2.2% to 2.4% in the United States. In February 2024, the annual inflation rate in Japan was 2.8%.

- In February 2024, the unemployment rate increased in Japan to 2.6% (from 2.4%) and in the United States to 3.9% (from 3.7%).

(%)

Source: Eurostat (ei_cphi_m) and (ei_lmhr_m) and the OECD

Source data for tables and figures

Data sources

Data for non-EU countries come either from Eurostat’s datasets or from an external source, such as the OECD Data Explorer.

Data for the euro area, EU and EU countries

- GDP, quarter-on-quarter and year-on-year percentage change, seasonally and calendar adjusted (namq_10_gdp)

- Industrial production, month-on-month percentage change, seasonally and calendar adjusted, and year-on-year percentage change, calendar adjusted (ei_isir_m)

- Economic sentiment indicator, seasonally adjusted (Directorate-General for Economic and Financial Affairs (ECFIN) – ei_bssi_m_r2)

- Inflation (based on the HICP), year-on-year percentage change (not adjusted) (ei_chpi_m)

- Industrial producer prices, month-on-month and year-on-year percentage change (not adjusted) (ei_isir_m)

- Import prices, month-on-month and year-on-year percentage change (not adjusted) (ei_isir_m)

- Retail trade volume of sales, month-on-month percentage change, seasonally and calendar adjusted, and year-on-year percentage change, calendar adjusted (ei_isrr_m)

- Household final consumption expenditure, quarter-on-quarter and year-on-year percentage change, seasonally and calendar adjusted (namq_10_gdp)

- Government final consumption expenditure, quarter-on-quarter and year-on-year percentage change, seasonally and calendar adjusted (namq_10_gdp)

- Gross fixed capital formation, quarter-on-quarter and year-on-year percentage change, seasonally and calendar adjusted (namq_10_gdp)

- Unemployment rate, seasonally adjusted (ei_lmhr_m) and unemployment in thousand people, seasonally adjusted (ei_lmhu_m)

- Hourly labour costs (based on the labour cost index), month-on-month, quarter-on-quarter and year-on-year percentage change, seasonally and calendar adjusted (ei_lmlc_q)

- Employment, quarter-on-quarter percentage change, seasonally adjusted, and year-on-year percentage change (not adjusted) (namq_10_a10_e)

- Employment expectations indicator, seasonally adjusted (Directorate-General for Economic and Financial Affairs (ECFIN) – ei_bsee_m_r2)

- Exchange rates (not adjusted) (ei_mfrt_m)

- Interest rates (not adjusted) (ei_mfir_m)

Data for Iceland, Norway and Switzerland

- GDP, quarter-on-quarter and year-on-year percentage change, seasonally and calendar adjusted (namq_10_gdp)

- Inflation (based on the HICP), year-on-year percentage change, all items (not adjusted) (ei_cphi_m)

- Unemployment rate, seasonally adjusted (ei_lmhr_m)

Data for China, Japan and the United States

- GDP, quarter-on-quarter and year-on-year percentage change, seasonally and calendar adjusted (OECD – Quarterly real GDP growth – G20 countries)

Data for China and Japan

- Inflation, year-on-year percentage change (OECD – Consumer price indices COICOP 1999 and COICOP 2018)

Data for the United States

- Unemployment rate, seasonally adjusted (ei_lmhr_m)

- Inflation (based on the HICP), year-on-year percentage change (not adjusted) (ei_cphi_m)

Macroeconomic forecasts

- European Commission Economic Forecast, see

- ECB Macroeconomic Projections, see

- IMF World Economic Outlook, see

- OECD Economic Outlook, see

Rates of change

For monthly data, 2 rates of change are presented

- M/M-1: change compared with the previous month

- M/M-12: change compared with the same month of the previous year.

For quarterly data, 2 rates of change are presented

- Q/Q-1: change compared with the previous quarter

- Q/Q-4: change compared with the same quarter of the previous year.

Context

The principal European economic indicators (PEEIs) represent a comprehensive set of infra-annual macroeconomic statistics aiming to describe the economic and labour market situation as well as price developments in the euro area, the EU and the EU countries; these statistics are of particularly high importance for economic and monetary policy.

The Communication of the European Commission to the European Parliament and the Council on euro area statistics Towards improved methodologies for euro area statistics and indicators of November 2002 defined the list of PEEIs and their timeliness targets, amended in the 2008 Economic and Financial Committee (EFC) report.

In 2002, Eurostat produced an initial list of 19 PEEIs, which subsequently expanded to 22. Data for these indicators are published regularly and posted in the dedicated Euro indicators section on the Eurostat website. Since 2002, PEEIs have been regularly monitored and improved in terms of coverage and timeliness. The list of indicators includes, for example, GDP, private final consumption, the external trade balance and the 3-month interest rate.

The progress that has been achieved with the timeliness and availability of PEEIs and remaining challenges are constantly monitored. Each year Eurostat, in cooperation with the ECB, drafts a Status Report on Information Requirements in the Economic and Monetary Union (EMU) which is submitted to the EFC and then to the Economic and Financial Affairs Council (ECOFIN). All reports can be found in the dedicated Euro indicators section under publications.

Direct access to

Main tables

Dedicated section

Visualisations

- Previous versions of Eurostatistics data visualisation:

Notes

- ↑ Following the Council Decision (2022/1211/EU) of 12 July 2022 on the adoption by Croatia of the euro on 1 January 2023, in line with past practice, all forecast numbers (in other words for 2022–24) for the euro area aggregate include Croatia with a weight of about 0.5%.

- ↑ From December 2022 onwards, the Eurosystem staff projections for the euro area include Croatia in view of its accession to the euro area on 1 January 2023.

- ↑ The euro area aggregate includes only OECD member countries (Croatia, Cyprus and Malta are excluded from the euro area aggregate as they aren’t members of the OECD).

- ↑ For further information, see Annual inflation down to 2.4% in the euro area – March 2024.