Extra-euro area trade in goods

Data from April 2024.

Planned article update: April 2025.

Highlights

In 2023, the euro area recorded a trade surplus of €69 billion.

Euro area trade with countries outside the Euro area increased between 2013 and 2023 with an average annual growth of 4.5 % with imports (4.8 %) growing faster than exports (4.2 %).

The main products traded by the euro area in 2023 were machinery and vehicles.

Euro area trade, 2012-2023

The aim of this article is to provide an overview of the main characteristics of the extra-euro area trade in goods. All the series have been recalculated to include all the 20 members of the euro area in 2023.

This article is part of an online publication providing recent statistics on international trade in goods, covering information on the EU's main partners, main products traded, specific characteristics of trade as well as background information.

Full article

Increase in extra-euro area trade

Between 2013 and 2023 there was an increase in both extra-euro area imports of goods (from €1 747 billion to €2 782 billion) and exports of goods (from €1 893 billion to €2 851 billion) - see Figure 1. This development decreased the trade in goods surplus of €146 billion in 2013 to €69 billion in 2023.

In 2023, contrary to the preceding years, exports fell 0.7 % while imports fell 13.3 %. Coming out of the COVID-19 slump, growth had been strong in 2021 with exports growing by 14.3 % and imports by 22.2 %. In 2022, driven by rising prices, growth was even higher, with exports growing by 18.2 % and imports by 38.0 %. In the period 2013-2023 euro area imports had an average annual growth of 4.8 % and exports grew by 4.2 % annually.

Main partners for extra-euro area trade

The share of euro area imports of goods from EU Member States outside the euro area increased by 4.5 percentage points (pp) between 2013 and 2023. In the same period China's share increased by 3.4 pp while the share of the United Kingdom decreased by 3.5 pp.

(%)

Source: Eurostat Comext DS-018995

The share of euro area exports of goods to EU Member States outside the euro area increased by 4.5 pp between 2013 and 2023. In the same period China's share increased by 4.1 pp, while the share of the United States decreased by 2.5 pp.

(%)

Source: Eurostat Comext DS-018995

Intra- and extra-euro area trade in goods by EU Member State

The share of intra-euro area imports varies greatly across members of the euro area. In 2023, it was above 60 % in Luxembourg, Portugal, Estonia, Latvia, Austria and Malta and below 40 % in the Netherlands and Ireland. The high share of Luxembourg is explained by it being surrounded by euro area partners. Ireland's main trading partners are the United Kingdom and the United States while the Netherlands high share is due to the presence of the large port of Rotterdam.

In 2023, Luxembourg and Portugal also had shares above 60 % for intra-euro area exports of goods. Finland, Ireland, Germany and Cyprus all had shares below 40 %.

Extra-euro area trade in goods by EU Member State

In 2023, the four largest importers of goods in the euro area accounted for two-thirds of all extra-EU imports. Germany accounted for 26.6 % of imports, followed by the Netherlands (18.3 %), Italy and France (both 11.2 %).

The same four countries were also the largest exporters, accounting for 70 % of extra-euro area exports. Germany accounted for 34.1 % of exports, followed by Italy (12.6 %), the Netherlands (12.3 %) and France (10.9 %).

Germany also had the largest trade surplus (€232 billion) with extra-euro area countries. It was one of eight countries with a trade surplus. Twelve countries had a trade deficit for extra-euro area trade which was highest in the Netherlands (€159 billion).

Machinery and vehicles dominate extra-euro area trade

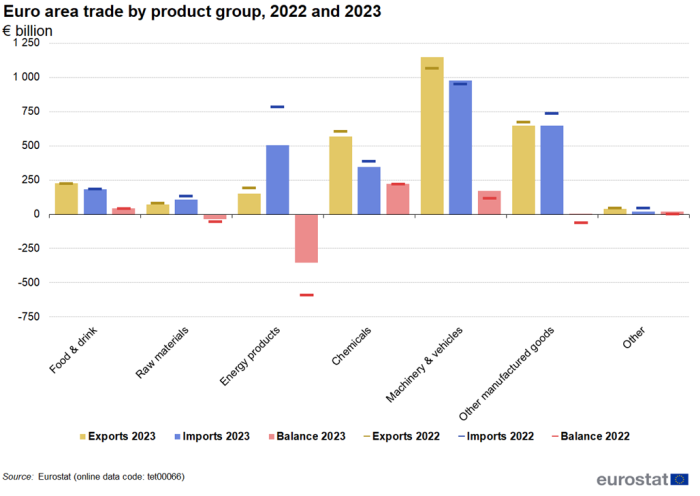

By far the largest trade group for both extra euro area imports and exports was 'machinery and vehicles', with a trade value in 2023 of €2 123 billion. Of this, €1 148 billion were exports, representing 40 % of the value of all extra-euro area exports in 2023. Imports of 'machinery and vehicles' amounted to €975 billion which was 35 % of total euro area imports. Compared with 2022, exports of 'machinery and vehicles' were up €84 billion while imports were up only €25 billion. Consequently, the trade surplus for 'machinery and vehicles' increased from €114 billion in 2022 to €172 billion in 2023 (Figure 9).

In 2022, the second largest product group for both extra euro area imports and exports was 'other manufactured goods', for which total trade amounted to €1 294 billion. Of this, €648 billion were exports, representing 23 % of all extra-euro area exports. Imports of 'other manufactured goods' stood at €646 billion in 2023 which was also 23 % of all extra-euro area imports. Compared with 2021, exports were down by €23 billion and imports were down by €888 billion. Consequently, the trade balance for 'other manufactured goods' went from a deficit of €63 billion in 2022 to a surplus of €2 billion in 2023.

In 2023, the euro area also had trade surpluses in 'chemicals' (€221 billion), 'food and drink' (€43 billion) and 'other goods' (€20 billion) while having trade deficits in energy (€353 billion) and 'raw materials' (€36 billion).

(€ billion)

Source: Eurostat Comext tet00066

Source data for tables and graphs

Data sources

Euro area data come from Eurostat's COMEXT database. COMEXT is the Eurostat reference database for international trade. It provides access not only to both recent and historical data from the EU Member States but also to statistics of a significant number of non-EU member countries. International trade aggregated and detailed statistics disseminated from Eurostat website are compiled from COMEXT data according to a monthly process. Because COMEXT is updated on a daily basis, data published on the website may differ from data stored in COMEXT in case of recent revisions.

Euro area data are compiled according to community guidelines and may, therefore, differ from national data published by EU Member States. Statistics on extra-euro area trade are calculated as the sum of trade of each of the nineteen members with countries outside the euro area. In other words, the euro area is considered as a single trading entity and trade flows are measured into and out of the area, but not among euro are members.

Among the euro area partners in this article there are countries belonging to the EU in the years mentioned such as Czechia, Hungary, Poland, Sweden and the United Kingdom (until February 2020) and partners outside the EU (United States, China, Switzerland, Russia and Türkiye). The statistical concepts applicable to these two group of partners is different. Imports from non-EU trade partners are grouped by country of origin where imports from EU partners reflect the country of consignment. In practice this means that the goods imported from EU partners were physically transported from those countries, but part of these goods could have been of another origin. For this reason data on trade for these two groups are not fully comparable.

Unit of measurement Trade values are expressed in billion (109) of euros. They correspond to the statistical value, i.e. to the amount which would be invoiced in case of sale or purchase at the national border of the reporting country. It is called a FOB value (free on board) for exports and a CIF value (cost, insurance, freight) for imports.

Context

The euro area is a large and open trading bloc. This makes doing business in euro an attractive proposition for other trading nations, which can access a large market using one currency. Euro area companies also benefit because they can export and import in the global economy while paying, and being paid, in euro, reducing the risk of losses caused by global currency fluctuations.

Direct access to